dallas county texas sales tax rate

For your convenience we have included a table below that lists the Texas sales tax rate for each county within the state. City or County Rates.

Tax Information City Of Sachse Official Website

Has impacted many state nexus laws and sales tax collection requirements.

. Name Local Code Local Rate TotalRate Name Local Code Local Rate TotalRate. The base rate of sales tax in Texas is 625 but the average range of Texas sales tax including the county sales tax rate is 725-825. Looking for Dallas County Election Information or Results.

2 State Sales tax is 625. Up to date 2022 Texas sales tax rates. Texas has a 625 sales tax and Dallas County collects an additional NA so the minimum sales tax rate in Dallas County is 625 not including any city or special district taxes.

How Does Sales Tax in Dallas compare to the rest of Texas. The current total local sales tax rate in dallas tx is 8250. Dallas MTA Transit stands for Metropolitan Transit Authority of Dallas.

Estimated Combined Tax Rate 825 Estimated County Tax Rate 000 Estimated City Tax Rate 100 Estimated Special Tax Rate 100 and Vendor Discount 05 N. How is Sales Tax Calculated in Dallas Texas. 214 653-7811 Fax.

Use our sales tax calculator or download a free Texas sales tax rate table by zip code. Lauras Income Tax Services El Monte. There is no applicable county tax.

33 rows Dallas County Has No County-Level Sales Tax. Sales Tax in Dallas Texas is calculated using the following formula. 2022 Tax Rates Estimated 2021 Tax Rates.

If you are buying a car for 2500000. TX Sales Tax Rate. This is the total of state and county sales tax rates.

Local tax rates in Texas range from 0125 to 2 making the sales tax range in Texas 6375 to 825. Automating sales tax compliance can help your business keep compliant with. The 2018 United States Supreme Court decision in South Dakota v.

You can print a 825 sales tax table here. Texas has 2176 cities counties and special districts that collect a local sales tax in addition to the Texas state sales taxClick any locality for a full breakdown of local property taxes or visit our Texas sales tax calculator to lookup local rates by zip code. The Texas state sales tax rate is currently 625.

Sales Tax and Use Tax Rate of Zip Code 75226 is located in Dallas City Dallas County Texas State. While many counties do levy a countywide. Texas has 743 seperate areas each with their own Sales Tax rates with the lowest Sales Tax rate in Texas being 625 and the highest Sales Tax rate in Texas at 825.

The Dallas County sales tax rate is. AddisonDallas Co 2057217 010000 082500 Allentown 067500 DallasMTA 3057994 010000 AngelinaCo 4003007 005000 AdkinsBexar Co 082500 Alleyton 067500. The combined sales tax rate for Dallas County TX is 725.

If you need access to a database of all Texas local sales tax rates visit the sales tax data page. Texas residents 625 percent of sales price less credit for sales or use taxes paid to other states when bringing a motor vehicle into Texas that was purchased in another state. The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value.

The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction along with the effective date and end date of each tax. The Texas state sales tax rate is currently. TEXAS SALES AND USE TAX RATES April 2022.

The Dallas Texas sales tax is 825 consisting of 625 Texas state sales tax and. 972-274-CITY 2489 Email Us. Higher sales tax than any other Texas locality Dallas collects the maximum legal local sales tax The 825 sales tax rate in Dallas consists of 625 Texas state sales tax 1 Dallas tax and 1 Special tax.

3 rows Dallas County TX Sales Tax Rate The current total local sales tax rate in Dallas. 2 State Sales tax is 625. Sales Tax and Use Tax Rate of Zip Code 75356 is located in Dallas City Dallas County Texas State.

The current total local sales tax rate in Dallas TX is. To review the rules in Texas visit our state-by-state guide. 625 percent of sales price minus any trade-in allowance.

The base Dallas Texas sales tax rate is 1 and the Dallas Texas sales tax rate Dallas MTA Transit is 1 so when combined with the Texas sales tax rate of 625 the Dallas Texas sales tax rate totals 825. City or County Rates. Dallas Texas Auto Sales Tax Rate.

The base state sales tax rate in Texas is 625. The Texas Legislature passed House Bill 855 which requires state agencies to publish a list of the three. The City of DeSoto Texas 211 East Pleasant Run Road DeSoto TX 75115 Phone.

Tax Office Past Tax Rates.

Tax Rates Richardson Economic Development Partnership

Liquor Sales Rep Salary In Dallas Tx Comparably

2021 2022 Tax Information Euless Tx

Texas Sales Tax Guide And Calculator 2022 Taxjar

How To File And Pay Sales Tax In Texas Taxvalet

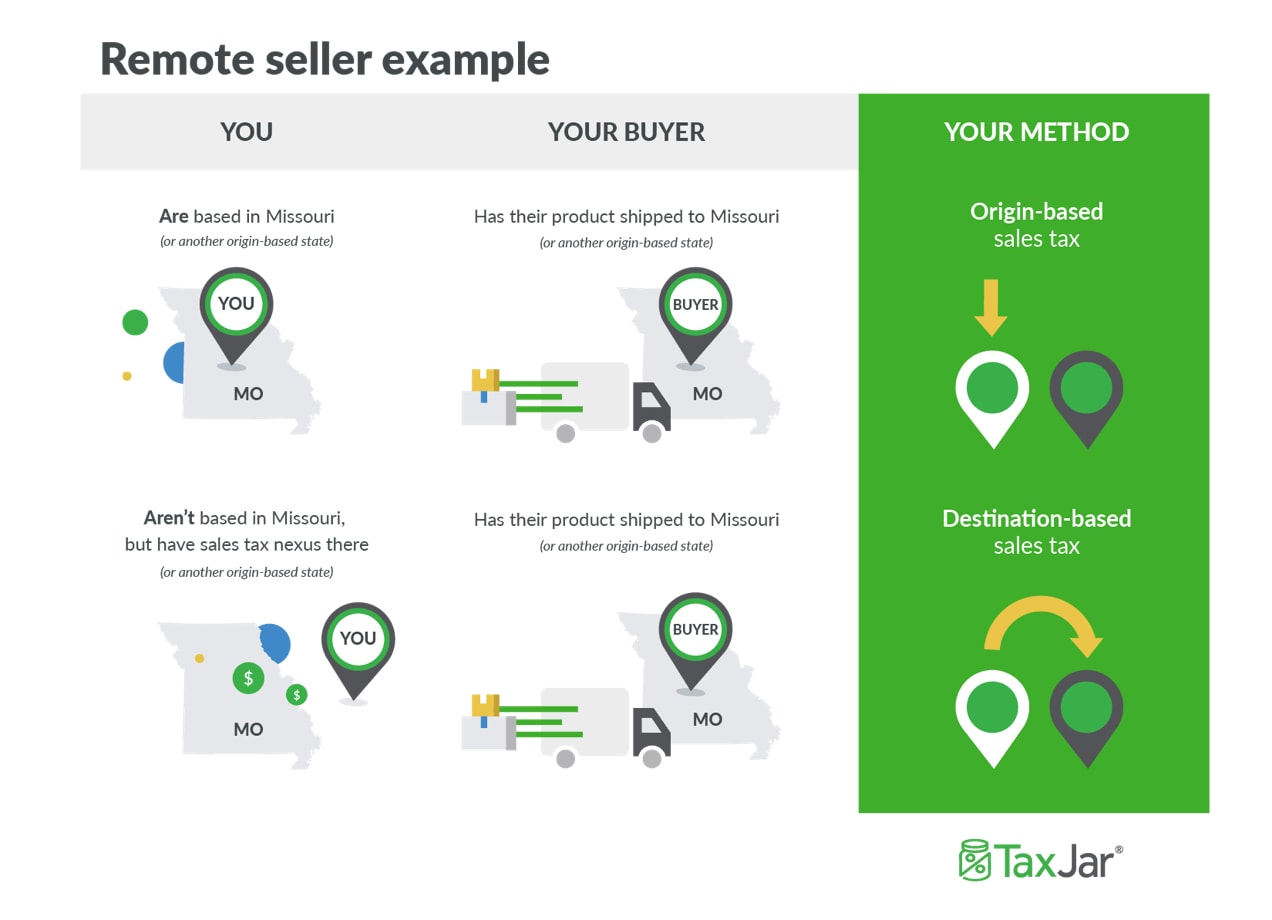

How To Charge Your Customers The Correct Sales Tax Rates

How To Charge Your Customers The Correct Sales Tax Rates

Texas Sales Tax Guide For Businesses

How To File And Pay Sales Tax In Texas Taxvalet

The Seller S Guide To Ecommerce Sales Tax Taxjar Developers

Texas Sales Tax Small Business Guide Truic

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

How To Charge Your Customers The Correct Sales Tax Rates

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

Texas Sales Tax Rates By City County 2022

How To Charge Your Customers The Correct Sales Tax Rates

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Car Sales Tax In Texas Getjerry Com

Electric Company Dallas Tx Electricity Rates In Dallas Direct Energy